TL; DR

Cursor has published a 2025 report for every user, and I enjoyed reviewing it. I couldn’t stop thinking about how the economics works for Cursor given the numbers. Therefore, I did some analysis based on my report and other reports from X. Here are the key takeaways:

- Even consuming 250 million tokens in 2025, I am an average user compared with other Cursor users. It means many enthusiastic vibe coders or professional coders are taking advantage of or exploiting Cursor.

- As an average user, I paid $180 for my subscription to Cursor, but used $838.55 to $2,014.95 worth of tokens. Cursor is spending more money on other power users.

- Users’ engagement is subsidized by investors’ money, similar to how Amazon, Uber and Airbnb acquired and retained their users. As history tells us, the current spending is not sustainable and will shift in future.

Introduction

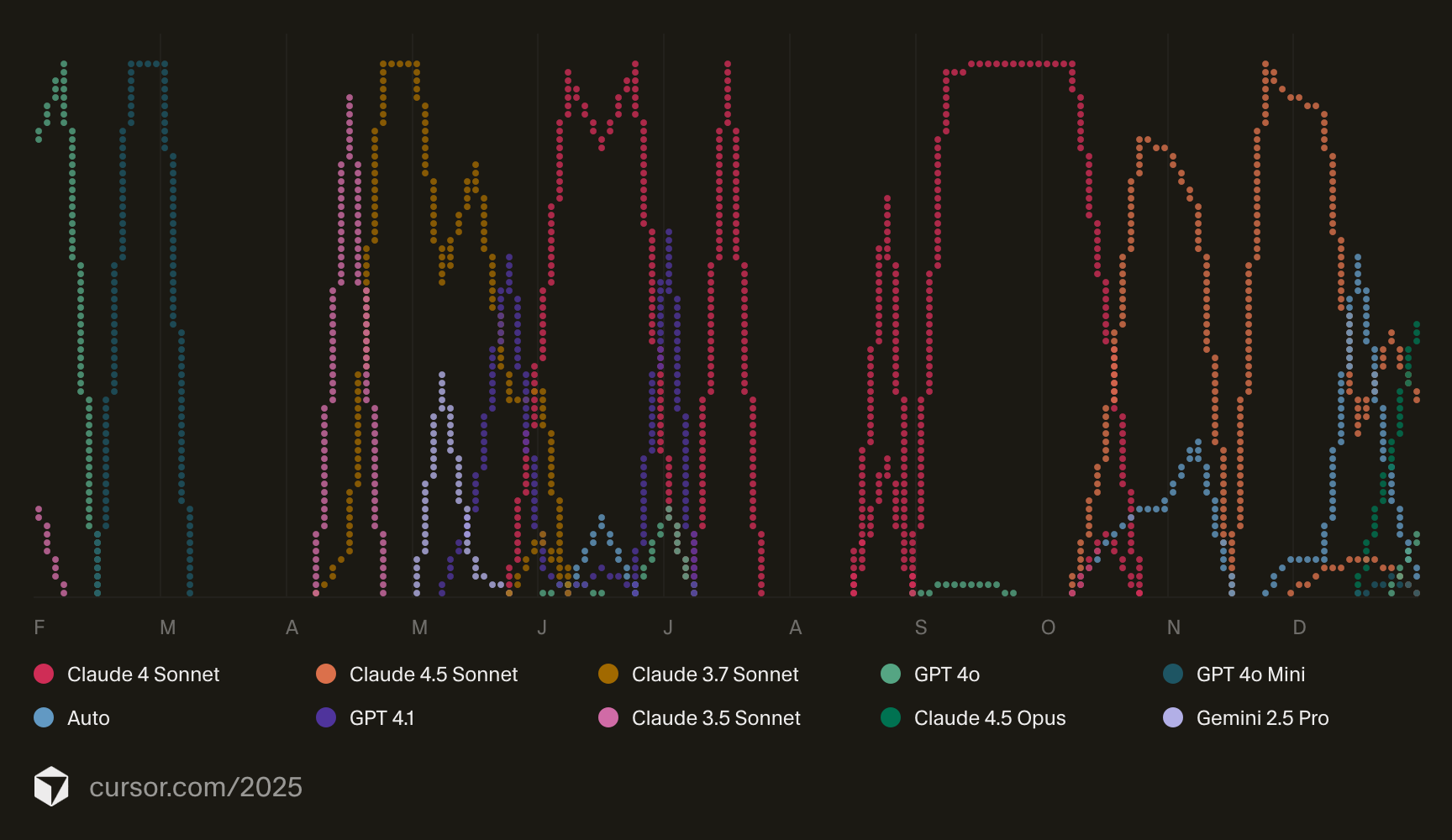

AI has changed my workflow as an engineer in the last 3 years. Instead of digging through Google results and Stackoverflow, I “chat” with Cursor and ChatGPT for coding problems, or directly assign tasks to AI coding agents. Below is a screenshot of my Cursor usage in 2025.

When I first read my Cursor 2025 report, I was pretty shocked that I’ve used 252 million tokens within a year. I proudly texted my friend: “I’m sure Cursor is losing money on me, and I’m a power user.” However, when I looked up the Cursor 2025 report on X, I realized the top 10% Cursor users generally consume more than 5 billion tokens in 2025. From a token consumption perspective, I might be an average user for Cursor.

How could Cursor justify their business model if an average user like me consumes more than 250 million tokens?

I could not wrap my head around the question, so I decided to guesstimate the economics behind Cursor.

My assumptions

If I want to comprehensively calculate my cost as a user for Cursor, I need to consider both variable costs and fixed costs. The variable costs include LLM API inference and Cloud infra; the fixed costs include employee salary and R&D investment. In this article, I will only estimate LLM API inference cost per user, since it’s directly linked to each user’s token consumption and less than the total cost of a user by definition.

Before we dig in to the estimation, we need a few assumptions about token price, LLM model, and token mixture.

Token price

Cursor enables users to choose major LLMs at their will, but Anthropic Claude is the most popular model family among users (including myself). Therefore, I will anchor the standard token price on Anthropic's official API price.

- Input: $3 per million token

- Output: $15 per million token

Enterprise price discount

Cursor is a major customer of Anthropic’s. Even their relationship can be very complicated—Anthropic prefers to directly own AI coding use cases via Claude Code. It’s safe to assume Cursor is paying less than the public price for each token by signing enterprise deals with LLM providers, owning dedicated instances, and using token caching.

Unless I work at Cursor and manage their operation cost, I won’t know the real price per million token for them. But I will continue my analysis with 3 price scenarios:

- 30% off

- Input: $2.1 per million token

- Output: $10.5 per million token

- 50% off

- Input: $1.5 per million token

- Output: $7.5 per million token

- 70% off

- Input: $0.9 per million token

- Output: $4.5 per million token

Input/output mixture

Given that input and output tokens are priced differently, but the Cursor 2025 report doesn’t break my 252 million token down by type, I need to estimate an input/output distribution. Obviously, users like me want to input simple but sufficient instructions and expect AI agents on Cursor to output quality code. For a more conservative estimate, I will assume my input makes up 30% of the tokens.

- Input token: 30%

- Output token: 70%

Equation to calculate API cost

Variables:

- T = Total tokens = 252.5M

- r = Input share = 30%

- (1 − r) = Output share = 70%

- P_input = $3 per 1M tokens

- P_output = $15 per 1M tokens

- d = Discount rate = 30% / 50% / 70%

Formula:

API cost = T × (r × P_input + (1-r) × P_output) × (1 - d)

This formula computes total API spend by taking the total tokens (T), applying a blended per-token price based on the input/output mix (r vs. (1-r))) and their respective rates (P_input) and (P_output), then applying the assumed discount by multiplying by (1-d).

API cost vs my subscription

I started a paid subscription to Cursor in April 2025, which adds to $20 * 9 = $180 in revenue.

Based on my assumptions and equation above, the estimated API cost is

| Discount rate | Cost |

|---|---|

| 30% off | $2,014.95 |

| 50% off | $1,439.25 |

| 70% off | $838.55 |

If Cursor wants to make the revenue and API cost break-even in my case, the discount rate has to be 93%. It means they must ensure P_input is below 0.21$ per 1M input tokens and P_output is below $1.05 per 1M output tokens.

I think Cursor is spending a lot more money on me than my subscription fee.

Other user data I found online

As I mentioned in the first part of the post, I am not a power user based on the Cursor’s own report. Here is a top 6% user from X.

Source: X post from @jcruzfff

If I plug this user’s token consumption into my calculation, the estimated API cost for Cursor is:

| Discount rate | Cost |

|---|---|

| 30% off | $49,795.2 |

| 50% off | $35,568 |

| 70% off | $21,340.8 |

Even if they were subscribed to the highest tier, they would only pay Cursor $200 * 12 = $2,400 for 2025 (unless they have enabled the “On-demand usage” option). It’s unlikely Cursor is making a profit on this user. I guess the real question should be: how much money is Cursor losing to keep users?

Conclusion

My estimation in this post is based on a rough assumption of LLM API price and does not include any cost from platform infra or fixed cost. However, it still demonstrates that Cursor users like me are using way more resources than they are paying for their subscriptions.

So who’s paying for the users? Investors.

The same incentive pressure shows up inside companies too—why “996/007” culture is spreading in AI is something I unpacked in Working 996 or 007 is not a competitive advantage for AI companies.

While everyone else is now paying more for Uber, Amazon, and food delivery services than they were 10 years ago, engineers and vibe coders can technically take advantage of this AI cycle.

How long can this last? Is this sustainable? I don’t know.

In 2025, AI has contributed a significant part of GDP growth in the US. AI coding is currently the crown jewel of broader AI adoption. Given my estimation in this article, there’s still a long way to turn investment into profit.